|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Mortgage Rates NC: Understanding the Landscape and Finding the Best DealsWhen it comes to navigating the world of mortgage rates in North Carolina, understanding the landscape can be daunting. In this guide, we'll explore key factors influencing rates and provide expert advice on securing the best deals. Factors Affecting Mortgage Rates in North CarolinaSeveral elements can impact the mortgage rates available to you in NC. It's essential to consider these when planning your home purchase or refinance. Credit ScoreYour credit score plays a significant role in determining the interest rate you'll qualify for. Higher scores typically result in more favorable rates. Loan Type and TermThe type and term of your loan can also influence rates. Fixed-rate mortgages may have higher initial rates compared to adjustable-rate mortgages (ARMs).

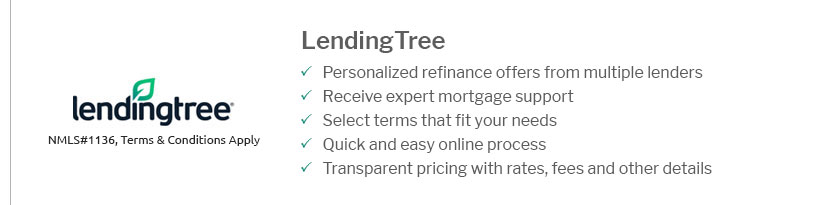

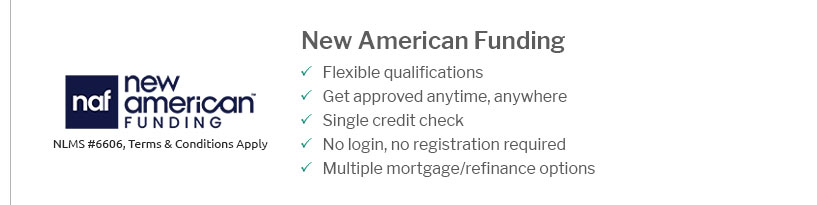

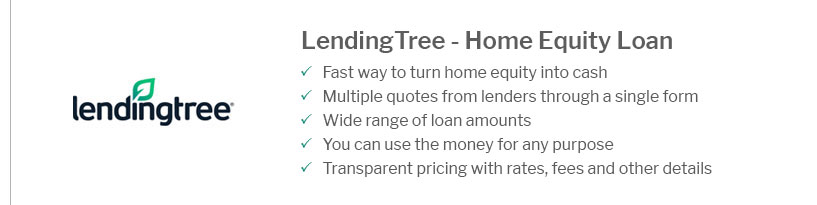

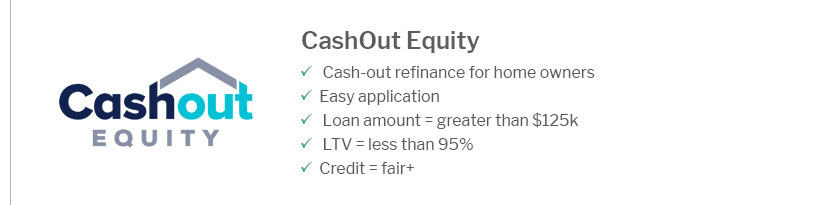

How to Secure the Best Mortgage RatesSecuring the best mortgage rate requires research and strategy. Here are some steps to consider. Shop AroundIt's crucial to compare offers from multiple lenders. This will help you understand the range of available rates and choose the most competitive option. Consider RefinancingIf you already own a home, refinancing might be an option to lower your rate. Learn more about how soon to refinance fha loan and determine if it's right for you. Improve Your CreditTake steps to improve your credit score before applying. This can open doors to better rate offers and save you money in the long run. Common Questions About Mortgage Rates in NC

FAQs

Understanding mortgage rates in NC requires time and effort, but with the right approach, you can secure a loan that aligns with your financial goals. https://www.bankrate.com/mortgages/mortgage-rates/north-carolina/

As of Friday, January 24, 2025, current interest rates in North Carolina are 0.00% for a 30-year fixed mortgage and 0.00% for a 15-year fixed mortgage. https://www.zillow.com/mortgage-rates/nc/

The current average 30-year fixed mortgage rate in North Carolina remained stable at 6.69%. North Carolina mortgage rates today are 1 basis point higher than ... https://www.nerdwallet.com/mortgages/mortgage-rates/north-carolina

Today's mortgage rates in North Carolina are 7.002% for a 30-year fixed, 6.164% for a 15-year fixed, and 7.250% for a 5-year adjustable-rate mortgage (ARM).

|

|---|